Business Training in Uganda

Refugee families coming into the camps receive a small plot of land to build a shelter and an allotment of food per month. This allotment is 15 lbs of corn flour and some oil. Any food beyond this and any other needs of the family must be supplied by the family. Lack of land to farm and local jobs often require the men to leave to find work. The women are left to support and care for their families. Many grow or buy and sell produce to survive. The purpose of this project is to give these women the skills to effectively run and grow their businesses, and to qualify for micro-loans.This project was done in conjunction with Living Water Community Transformation (LWCT) and Pastor Dima and his association of South Sudanese Churches in the Uganda Refugee Camps.

Below you will find a case study on the development of the curriculum, a close-up look at the first class we taught, and testimonies from five ladies who went through the training and received micro-loans.

Case Study: Business Class Curriculum

The curriculum for this business class was adapted from “Simple Bookkeeping and Business Management Skills. For small scale entrepreneurs.”

This document was developed and illustrated by Ms. Ria Meijerink (RAFR Consultant) under the guidance of Ms. Diana Tempelman, Regional Officer, Women in Development (RAFR). The work was co-funded by FAO’s Regional Office for Africa and the Women in Agricultural Production and Rural Development Service (ESHW) of FAO Headquarters. The original document was written for Ghana to teach oral learners the basics of running a business. The forward indicated it could be used and adapted for use in other countries.

We modified it for the environment in the refugee camps in Uganda, reflecting actual products and services, common business practices and pricing in Ugandan Shillings. Although most students read and write, we even kept the pictures vs words for recording purchases and sales in the ledger to make it easier to teach a mixed language class.

Although the original course had a section on profit and loss and business management, we included more content on good business practices, and a template for writing a business plan. This helps our students think through their businesses in a more organized way, avoid big mistakes, and will be extremely helpful when applying for a loan.

We also developed a student guide to go along with the course, to help the students document important information to take with them when the class is over. Below is the outline of the course.

LESSON 1 THE IMPORTANCE OF BOOKKEEPING

LESSON 2 THE USE OF SYMBOLS IN BOOKKEEPING

LESSON 3 INCOME AND EXPENDITURE

LESSON 4 THE USE OF THE CASH BOOK

LESSON 5 PROFIT AND LOSS

LESSON 6 HOW TO USE THE PROFIT

LESSON 7 BUYING AND SELLING ON CREDIT

LESSON 8 THE CREDIT BOOK

LESSON 9 COSTING AND PRICING

LESSON 10 BUSINESS PLANNING

LESSON 11 BUSINESS MANAGEMENT

LESSON 12 BUSINESS PLAN

Close-up: Teaching Business in the Morobi Refugee Camp Village

Arun and I taught a business class in the camps. It was an hour and a half drive over dirt roads to get to the Morobi Refugee Camp Village, in Palorinya. As we got within a few miles of the camps, we began seeing refugees walking along the road. They start early and walk for hours to get to the markets. They purchase supplies in bulk, and pay for transport back. Then they sell their products in the local market. This is commerce in the refugee camps. As we entered the Morobi camp, we saw the U.N. compound, where each refugee gets the equivalent of three 5 lb bags of corn flour and some cooking oil for each family member per month. That’s it. Families end up selling part of their food to buy other necessities, medicine, or pay school fees. They plant crops on their small plot of land, but there isn’t room to grow much. If there is a husband, they often leave to find work to help support their families. Sometimes they don’t return.

As we arrived at the church where we were to teach, we prayed that our class would be useful to these women. The church was framed with rough-hewed logs and wrapped in UN stamped plastic, the only building materials refugees are provided to build shelters. The women arrived, a few at a time, over the next hour. They were friendly, but quiet as we started handing out class materials and began our class. There was two tailors and one who sold used clothing. The rest sold a mixture of tomatoes, onions, beans, maize, ground nuts, silver fish, eggs, rice, salt, and sugar. Some produce they grew, but most they purchased in quantity and resold in smaller quantities in the local market.

As they shared about their businesses, Alice wanted to know how to keep her husband from taking her business money. Harriet wanted to know how to keep her grandkids from using the sugar she had to sell. Many wanted to know how to increase the number of products they sell, so they could better provide for their families.

By the second day, the women were there before we arrived, singing and clapping as we drove up to the church. Some of the concepts were simple, like keeping personal money separate from business money, or writing down every time money exchanged hands. Others, like determining the profit per product or setting a price for their products, was a bit harder. As the women gained understanding, you could see it on their faces. Sometimes they spontaneously clapped as the light-bulb came on.

Our curriculum was Bible based, and we used scripture to reinforce good business principles. The women actively participated in our daily devotion, reading passages out-loud in Bari, and participating in the discussion. I was grateful to God that I had the opportunity to hear Alice’s story of how she ended up supporting her sick husband, her two children and her husband’s

first wife’s three children. I was able to encourage her and pray with her. Ester’s mother-in-law died the first day of the class, but she onlv missed one dav. was able to pray with her as well.

At the end of the class, we outlined the process that will be used to provide micro-loans to those who need funds to expand their businesses. It took a while for it to sink in that the 6% interest that will be charged is 0.5% per month vs the 10% per month going rate in the camps. They didn’t understand that at the end of the year the debt would be paid. The lenders in the camps only require the interest payment, but it never ends. When they realized this, they clapped and clapped.

It was tremendously rewarding to equip these women to better provide for their families. We are fortunate that Scovia, from our partner organization, is there to help these women, and to teach this class to others. Pray for these women, that they would strengthen and grow their businesses, and would give God the glory.

Muraa Cicily Buys More Clothes to Sell

This is Muraa Cicily, she sells second hand clothes and shoes, she takes them from one market to another in order to make more sales. She is so thankful to God for helping them through this program. She was able to make more sales and order more items for the 3rd time therefore she’s so grateful for that because she already got more than what she borrowed. She also thanks our team from US for the businesses training. The skills she got from the training helps her alot especially when running her business

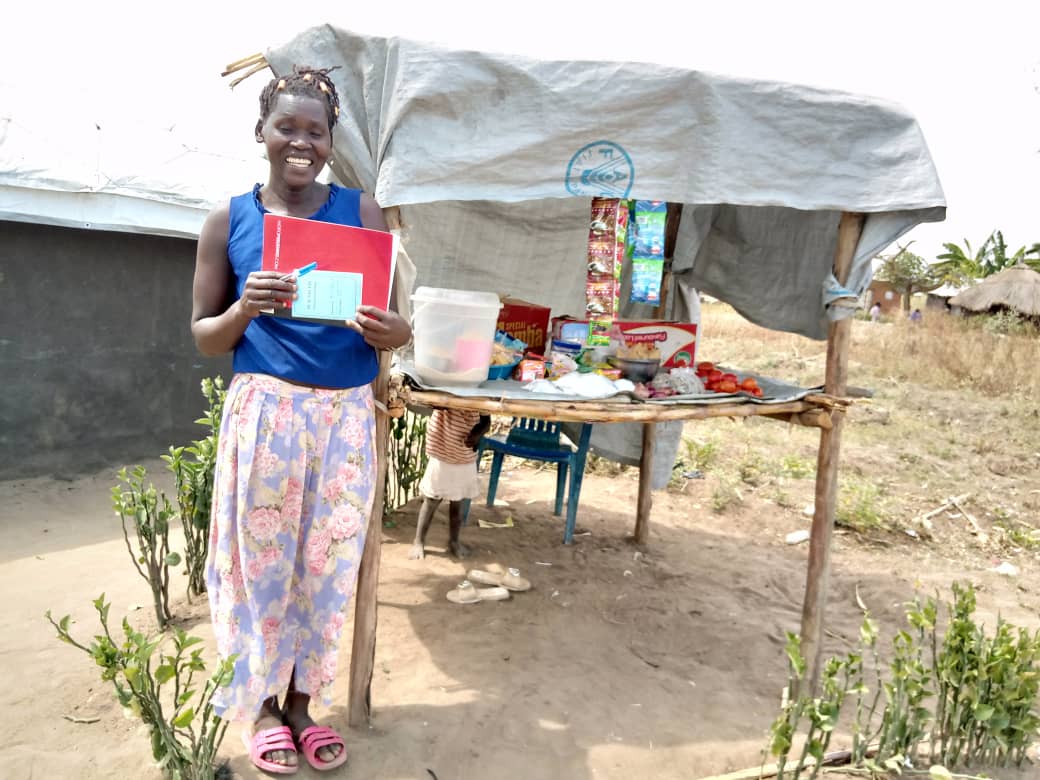

Ropi Felista Expands Her Business

This is Ropi Felista, she sells food items. She gives thanks to God for this program because it has helped her expand her business, she’s able to make a temporary shade for selling her items because she sells from home. She is able to buy more products because in the business classes she learned that the more products you buy, the less the cost becomes. She divides her products in two. She takes some to the nearby market and she sells the remaining ones at home. She is also able to save money and send a child to school today with the money she got from her sales. She can now record her income and expenditure in the ledger so she’s thankful for the training because she was able to learn alot of things which helped her run her business successfully.

Kemisha Jane Sews More Clothes

This is Kemisha Jane, she’s a tailor. She is also thankful because this money has been of great help to her business. She ordered more rolls of fabrics for the first time in her life since she became a tailor. She is just happy because after showing clothes from the fabrics she purchased, customers bought all of them during the Christmas season and she has planned to order material of different colours to start making school uniforms. She also bought some items and started operating on a small shop at home and it is doing just well. She’s just happy because it’s the first time she’s feeling positive about her business.

Selina Poni Makes More Sales

This is Selina Poni, she sells beans, maize and simsim. She thanks God and the team for the business skills impacted in her during the business classes because it’s helping her run her business successfully. She borrowed the money and put it in use immediately as a result, she was able to buy more and make quick sales and order more again. She’s thankful and happy that the business is helping her family so much.

More Fabric For Yiki Alice

Yiki Alice is also a tailor, she ordered more rolls of fabrics, made and sold the immediately and she’s ordering more fabrics and materials to start making school uniforms. She is so grateful Because through her business, she’s able to send her daughter who is in a candidate class to a boarding school, save money and feed her family as well.